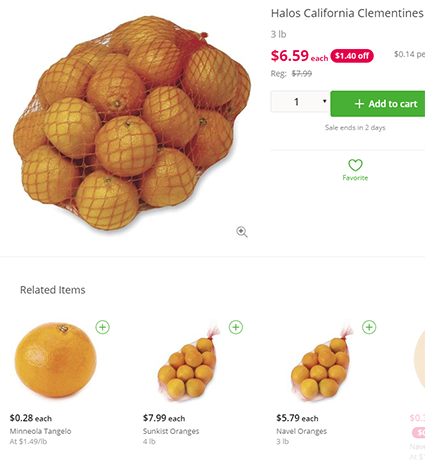

Produce shippers have many legitimate concerns around digital marketing and omni-channel retailing. Take a look at this image we screen-shot while looking to order Clementines from Publix via Instacart:

Note that the text says these are Halos, but the graphic does nothing to indicate or differentiate the brand. In fact, we wonder whether we would even have gotten Halos. We were in the Publix store where the deliveries are pulled from for our location, and they had Seald Sweet’s Mandarina’s brand. So, we’re not sure who should be more upset — Wonderful, whose Halo brand is being used in vain… Seald Sweet, which is not getting impressions for its own brand… consumers, who will find shopping difficult … or Publix, which can’t even try to realize a premium on anything if the marketing is confused.

Of course, Sunkist is going to be unhappy as well. Look at the bottom of the image. Note that Sunkist oranges are marketed at $7.99 for a 4-lb. bag, whereas a generic 3-lb. bag of Navel oranges is marketed at $5.79. But here is the kicker: Both bags of oranges are marketed with the exact same graphic! No famous Sunkist logo or Sunkist colors – and if one is ordering off a mobile phone, the word Sunkist is so small that scarcely a person over 50 will even see it. It is hard to even see that Sunkist is giving you 4-lbs. rather than three for the generic.

So, what happens to brand-building? How can anyone get a premium?

And things may get even worse… Voice ordering is the next big thing, and there are no visual cues at all!

How can shippers and retailers avoid an undifferentiated, low profit, pure commodity future?

This was a clear issue we wanted to deal with at The Amsterdam Produce Summit, and we knew just the person to help. Lisa Cork, an American long living in New Zealand, has built a reputation in wrestling with brand and packaging issues in the fresh produce arena. She has won wide praise for many presentations including these:

Lisa Cork To Address London Produce Show And Conference: Packaging As A Marketing Tool

Fresh Produce Marketing: The Real Deal

She’s been doing a major deep-dive into omni-channel retailing and is traveling halfway around the world to share her findings with us.

As a preview to the Amsterdam Produce Summit, we asked Pundit Investigator and Special Projects Editor Mira Slott to find out what Lisa is planning for Amsterdam. Her presentation is so CHOCK FULL OF VALUE that one “sneak-preview” piece won’t suffice! So, we’ve broken it up into Two Parts. Here is Part I of our preview of what will be a ‘must see’ presentation:

Lisa Cork

Lisa Cork

Owner

Fresh Produce Marketing

Auckland, New Zealand

Q: You’ve enthralled and challenged produce executives with your in-depth research and innovative strategies for branding and packaging success at our London Produce Show and Conferfence and The New York Prodce Show and Conference.

Now you take on these issues to help the produce industry prosper within an omni-channel future…

A: I believe this topic is so new that people aren’t really talking about it in Fresh… just in CPG. I’m excited to present my findings. It’s been shocking to unlock the gap between the philosophical side of online shopping and the reality of online shopping, which are miles apart.

Right now, I don’t see produce synergies of omni-channel in offline, online and social media. What I’m observing is in CPG, where there is more development and for a range of reasons — most notably because the items are non-perishable and packaged. There are some really innovative startups in CPG that have come into the omni-channel environment without an offline brand but using the online exposure to go offline. One of them is a Kiwi start up, called Allbirds, which sells Merino shoes, even our Prime Minister wears them!. First it was a brand that started online, via social marketing, before becoming available in select bricks-and-mortar. I believe one of their first stores was a pop-up in San Francisco! My husband bought a pair online… he never saw them, never tried them on… just bought the shoes based on a social promo on Facebook and word of mouth!

When you look at that trajectory of those brands arriving in the omni-channel world with no history, they can create an integrated branding, packaging and social media strategy across channels. There’s nothing tethering them to a past; they’re seeing what’s ahead of them. We absolutely will see this trajectory amplified.

In looking online and shopping for the past few months, I haven’t seen any of this in produce. There seems to be a divide between on line and off-line synergy in produce. We won’t be able to ignore it over time.

Q: Aren’t there omni-channel trailblazers in the produce arena?

A: Ocado stands out as a world leader from a fresh perspective. But China is leading in truly embracing the Jack Ma omni-channel. China has the capacity to move so quickly. Four years ago, I didn’t even know of Hema… Hema Fresh is visionary — nothing like I’ve ever seen before.

What worries me is companies afraid of change and the unwillingness to take a leap when there is no safety net. I can see why start-ups can move fast; they’re coming in with a light backpack and not dragging a suitcase of history and budgets. If you’re a mainstream brand, this will be very confrontational, because it will be harder to justify budgets for big leaps, but if you’re looking out three years, you must be making those decisions now. That’s the huge gap for our industry that needs to be addressed right now.

Q: What are these shocking gaps you’ve uncovered in the ways fresh produce is handled in the omni-channel arena? Do the big leaps you advocate intersect with branding, packaging and marketing strategies?

A: Branding and packaging is changing. The way we design packs and create brands is morphing… I am looking ahead, doing an environment scan, and I am seeing companies that are absolutely not looking ahead at all or companies that are ‘waiting’ for everything to be right. Look, the future of how we brand, pack, tell stories, build brands is about to change. The companies that are proactive, that engage in this now even though it doesn’t feel perfect… those are the ones that will be somewhat prepared for the change.

The reason I feel so strongly about this is I am living this first hand through my work in China right now, leading the branding, packaging and marketing for clients that are selling omni-channel in China for the past three years. I am seeing the future, and this gives me credible insights. I have also made mistakes — but what I know is you must jump in and fail sometimes to learn.

I want to help produce companies be prepared for what’s coming. With omni-channel fresh right now, there is no right answer. As I have found in China, success will go to the companies that jump in, try, succeed and/or fail fast, then try again.

Q: Since the Amsterdam Produce Summit will have key retailers/buyers attending — Ahold, Rewe and Walmart, for example — and also a diverse supplier side, could you provide your insights from these different perspectives, and also from the consumer’s perspective?

A: First, there are many big issues unique to each type of business. If you are big retail, you are facing significantly different issues than if you are a fresh produce supplier trying to break into online selling. As a strategist and marketer for fresh produce suppliers, I’ve defined three issues — what I’ll call the three D’s — that stand out for me in the emerging, omni-channel world: Disruption, Data and Diversity.

No doubt, disruption is one of the most over-used words of this decade. But, in addressing the big issues, we have to acknowledge we are in a time of significant disruption. I saw a great analogy that made the following points:

-

The world’s largest taxi company owns zero vehicles (Uber).

-

The world’s most popular media owner creates zero content (Facebook)

-

The world’s most valuable retailer has zero inventory (Alibaba).

-

The world’s largest accommodation provider owns zero real estate (AirBNB).

Amidst all this change, the retail food industry will face disruption… and this is a good thing. With food waste and plastic packaging on everyone’s lips, with health and wellness becoming more important, with consumers seeking transparency and an understanding of where their food comes from, a fresh perspective on how we buy, sell and consume food is in order.

I lectured in food marketing at Massey University in New Zealand for a few years, and what retail history tells us is food retailing has faced multiple disruptions in its history.

For example, in 1916, Piggly Wiggly was the first retailer in the USA to move from counter service to self-service. During my presentation, I will show a fantastic ad, circa 1928, which has the headline, “Today, she makes her own decisions.” It describes how when shopping, a female consumer no longer has to wait for the sales clerk to stop chatting or no longer has to take what the sales clerk gives her. Today, she can make her own choices.

Q: Is it ironic that to counter Walmart and discounters, supermarkets looked to increase service…?

A: Yes! You know what I picture in my mind when you say this… remember the clown that you used to be able to punch that would never stay down? Look at just how adaptive food retailing is, how adaptive supermarkets are. In the face of constant change, bigger, bolder more aggressive competitors, from full service to self-service back to full service, from offline to quickly jumping into online – look at how responsive they have been. This brick-and-mortar model is not going away any time soon as long as they continue to reinvent as they have been doing.

Pundits at the time noted that while some shoppers did not like this new, ‘impersonal’ way of shopping, “the majority of people embraced the self-service supermarket as a new freedom — especially the younger generation who were looking for modernity and independence.”

Look how transportable that quote is to the present time. With online data, especially in the USA where online food buyer demographics are skewed to Millennials, you could literally rewrite that quote to be, “the majority of people embrace ‘online supermarkets’ as a new freedom — especially the younger generation who are looking for modernity and independence.”

Q: Studies show in-store shopping preferences with fresh produce — touch, aroma, quality verification combined with online knowledge and other values — increase total sales and maximize synergies throughout the store…

A: You are right. What you are describing here is the new consumer decision-making journey. It used to be straightforward and linear. Now, with instant access to any info at our fingertips, the journey is more complicated. This means loyalty is not guaranteed because instantaneous comparisons are easier than ever. And, word of mouth reigns king.

So, 102 years ago, food retailing dealt with a major disruption, and there were plenty more disruptions along the way. Online retailing and home delivery started in the UK in the 1990’s. While it seems new to some, for others this mode of shopping has been around for nearly 30 years. Or take a look at China, which leap-frogged the modern format retail trend almost entirely and went straight to online and integrated payment systems.

My point is — while it feels like food retailing has gone crazy and nothing is as it was, my advice to suppliers is: Take a deep breath, be open to change and get your marketing, branding and packaging sorted for an online world even if the supply side equation isn’t fully working for you yet.

Q: How does data — your second “D” — come into play?

A: While CPG (consumer packaged goods) and bar-coded fruit and vegetables have been accessible to supermarket scan data, the transition to selling food online impacts the data available. Supermarket scan data now and into the future will only provide part of the sales picture, not the whole picture. Amazon and Alibaba already control huge chunks of consumer and purchase data — and I am not sure how willing they are to share. Understanding your consumers and understanding what they are buying (e.g., where and when and what) will become more challenging.

On the consumer side, they have access to more data than ever before. Reviews, comments, star ratings, etc., are influential marketing tools — and word of mouth continues to increase as a source of trusted information about products and brands. That’s all well and good until data goes wrong.

Case in point: If you are selling a book and a consumer writes a good review or a poor review, the essence of the book does not change over time. So if a book review is rated by the community as being ‘helpful’, it doesn’t matter whether the book review is a year old or four years old, the book hasn’t changed.

Now apply the Amazon selling and customer-review formula to an item like fresh grapes, which changes every day. Suddenly, a review about poor quality grapes that is rated ’helpful’ by others becomes quite unhelpful when that review was 3 years ago!

Q:I’m surprised there isn’t a system in place to alleviate this problem…

A: At the moment, it appears to be just how the Amazon system works — like they have transferred the customer referral technology straight across to fresh, with no thought on the implication. Maybe I am the first one to really notice and pay attention! As for a fix, it seems like Amazon needs to get some produce expertise on the team — and not just 20-something tech gurus. Hey Amazon, I’m really open to working with you to make your fresh produce online sales offer a much better experience for consumers! Call me…!

One of my services to help companies prepare for online selling is to research them and show them the consumer feedback they are getting online. Most companies have no idea the beating their brand is taking in areas like this more ad-hoc consumer feedback.

So consumer data can be a good thing, except when the data collection, evaluation and reporting mechanism is fundamentally wrong.

The third big issue all companies will face is diversity and the fact there is no one, single ‘online food shopper’ segment. The matrix of variables — for companies that want to market food or fresh produce online — is complex — especially if you want to supply global markets as well as your home market. Add to this the differences between online selling, marketing, branding and packaging vs offline selling, marketing, branding and packaging, and it is no wonder fresh produce companies are merely trying to survive in an omni-channel world at the moment.

Q: When you put it that way, perhaps it’s more understandable companies hesitate on jumping in full force without that safety net you analogized…

A: In my work with companies looking to future-proof themselves and their brands in an online world, senior leadership teams that want to be successful both offline and online need to change their mindset and skillset.They have to become more adaptive, integrated and trust their teams, especially younger team members.

I believe fresh produce companies must plan for an online sales world — even if they are not actively selling into that world yet. The thinking required to be a profitable, successful online food or fresh produce brand in the future must be done now.

Q: What are the best ways to maximize the benefits of omni-channel? From the retailer perspective and from the supplier perspective, how can they use branding/packaging to build overall sales? By integrating these channels, can a company raise business to a new level?

A: To be honest, I don’t think anything has changed about the golden rule of selling: be in the right place, at the right time, with the right offer at the right price. What omni-channel selling has done and what disruption in food retailing has done is it has made getting to consumers at the right place, right time and with the right offer and price more complex. The complexity of selling and the channels for selling and the markets for selling have increased, but the basic rules still apply.

Q: Could you provide examples to shed light on the complexity?

A: Let’s specifically talk branding and packaging. Let me make up a scenario. Say you are Driscoll’s — as they are a well-known brand. To supply a brick-and-mortar store, you are sending in cartons filled with punnets of your branded product. From the shoppers’ perspective, if they want blueberries, they find the berry section in the produce department and have the opportunity to buy Driscoll’s plus other brands if the retailer stocks product from multiple suppliers.

Standing at the point of sale, the brick-and-mortar shoppers use their senses to determine whether to buy the blueberries. They read the writing that says Driscoll blueberries are a ‘special pick’ and Jumbo-sized. They see inside the pack and visually confirm that indeed, they are large blueberries. They can pick up a different brand and visually compare size, price and quality. All of the information they need to make a decision is in front of them.

Now, let’s create a similar scenario online, say on FreshDirect.com. For the online shoppers, their experience with blueberries starts when they enter the word Blueberries into the search bar. Suddenly there is a range of choice in front of them — fresh, frozen, yogurts, waffles, etc. These are no longer defined ‘by department’ or store schematic, and they have an array of choice at their fingertips.

Our mock shopper still wants fresh blueberries. But now making a choice gets harder as she cannot easily evaluate the offer using her senses. She is limited to making her decision based on what her PC or, increasingly, what her mobile screen is showing. Not being sure why there are price point differences, she drills down into each offer.

Within the Driscolls offer, she reads they are ‘Driscoll’s Jumbo Blueberries.’ She can evaluate the picture of the punnet — but can’t be 100% sure what she is seeing is what she will be getting. She backs out and has a look at the other offer. This is a larger punnet (11oz vs 6oz) AND the price is less expensive ($4.99 vs $6.99). The written ‘promotional blurb’ for these generic blueberries is identical to the written ‘promotional blurb’ for the Driscoll’s blueberries.

The size of the blueberry looks big in the photo — but there is no way to determine how big the blueberries are vs the Driscoll’s berries. She does see there is a slight difference in the FreshDirect.com Produce Quality Rating; the Driscoll berries are 4.5 stars and these are only 3.5 stars, but she doesn’t feel the difference is compelling enough to pay more for a smaller punnet. So, she selects the larger, non-branded, less expensive blueberries.

Q: Does this change if she builds confidence over time by shopping with Fresh Direct and ratings are proven out, etc. Also, what if it’s an omni-channel retailer, where she’s familiar with brand from shopping in-store?

A: Part of this comes down to trust. When you shop in-store, you trust your judgement. You use rational cues (price, brand, pack size) and sensory cues (see, touch, smell, thump, etc.) to make a decision. This could be happening in a nano-second or it could take 2-3 minutes to select the right fruit or vegetables for your criteria. Online, suddenly your control is gone. Now you have to trust someone else.

In a distribution center (DC) fulfillment situation, you need to trust total strangers who will pick fruit like you would; they will see the bruise you would normally avoid; they will pack it in the tote like you would. This is where I am a bit skeptical about cues like freshness meters. If a DC ‘order picker’ doesn’t notice the few rotten or smashed grapes in the middle, or the bruise on the apple, does a cue like the freshness meter count? Maybe this is where omni-channel retailers will have an advantage. Customers do trust the brick-and-mortar banners they shop at. So, when that brick-and-mortar store offers online shopping via Instacart, you would have to believe there is more trust there than in a situation like Amazon, where there may not be a real store nearby.

This example should serve as a warning to all fresh produce suppliers. Yes, omni-channel sales offer new opportunities to reach consumers. But, if you are selling into online channels where you have no control of your brand or how your brand is being presented online, your brand is being devalued and you are losing sales.

Q: Excellent point… Is it important to maintain consistency and brand unity across the omni-channel spectrum, and if so, what should that be? If consumers are ordering on line, should they see the same branding and packaging as in-store or is that not important? Are there other ways to maintain consistencies, or are they different customers who prefer different formats?

On the part of retailers, how should they perceive this; and the supply chain… should they be viewing these as different products?

A: The best response to this question is the Thai phrase, “Same, same, but different.” Yes, it is important to maintain consistency and brand unity across both offline and online channels, but each channel needs a customized strategy due to differences in how the brand and pack is presented.

Q: How will intersection of technology and omni-channel impact strategies for marketing, branding and packaging? For instance, it’s more difficult to get a visual cue for produce than for a box of Tide on a mobile phone…

A: In-store, where shoppers can pick up a pack, see the product and read brand information, there is more space to inform, inspire and influence purchase. When I speak or conduct workshops with clients, I always tell them, “In-store, you need to view your packaging as a mini-billboard. It is the most important and cost effective sales tool you have, and it must work hard to promote your brand/value proposition.” For a lot of growers, their packaging is the only marketing tool they have — so it must work hard to drive sales and value.

Let’s use Cuties Mandarins as an example.

In store, if I am shopping the citrus category, the Cuties brand and pack stands out. It has eye-catching graphics using a smiling Mandarin with the zipper. It has a bold, blue band. It uses key words that are important to shoppers, like ‘seedless’ and ‘easy peel.’ And the branding is identical across all three pack sizes — 2lb, 3lb and 5lb. This gives the brand a strong presence on shelf. The fact the bags all look the same across sizes is not a problem instore, because you can easily see the weight differences.

On-line, the dynamics change. It starts with a search for mandarins. Given the way search works, I again get served up a whole range of Mandarin products — which may or may not include Cuties. This does not mean the online store is not stocking them, but retailers typically use generic or stock photos to showcase their offer — so a Cuties image may not be used if the retailer has uploaded a generic Mandarin photo. Or the retailer may be using a thumbnail from a pack photo, but it is not sized or optimized for online use.

You’re playing in a space where there is nothing, no rules, and the first mover is really important; tell a retailer, ‘actually you can’t use a photo of my packaging and have another brand associated with it.’ We have to have the balls to establish how our brands are portrayed on line.

Q: What if the consumer types in the brand Cuties?

A: Current AmazonFresh.com Cuties search reveals Mandarins. But drilling down further reveals the Mandarin brand is ‘Sunkist Smiles.’ Cuties seems to be popping up because of customer feedback mentioning the brand.

Trying by voice — Alexa, order Cuties Mandarins and you get a banner ad for Cuties diapers, Mandarin oranges, 3lb, same listing as above, Cuties Mandarins 5# bag from The Neighborhood Corner Store. When doing a voice order, Cuties diapers come first!

So even though our shopper loves Cuties, she may not be able to buy or find them online. Additionally, she might get side-tracked during her ‘search’ and buy a more attractive offer.

If she does find Cuties on offer, the next issue she faces is that all three pack sizes noted above now show up online looking exactly the same. Because the offline bags are identical and they form the basis of photos being used online, everything looks the same. Can you see the challenge? Without deep-diving into each description, it is easy to order the wrong size.

Omni-channel brands and packs do share similarities. But at the same time, they need to have key differences. In our work with clients who are selling both off and online, we are working hard to create rules and guidelines that help clients differentiate and showcase their offer in different channels.

This all comes back to the point I made earlier. In an omni-channel environment, if you are not aware of and in control of your brand, you will lose sales and damage brand value.

I addressed the consumer brand and packaging question. But there is another part of the question to respond to – packaging produce to survive online selling and delivery.

Q: Please elaborate…

A: Visit any online retailer selling fresh fruit or veg that is sharing consumer feedback, and you will easily uncover the major issue with selling fresh produce online — it is not easy to pick, pack or deliver it to a customer in pristine condition.

Let me give you an example from AmazonFresh, as it has the best consumer feedback section.

I think we can all agree — bananas, as a fruit, are hard to get wrong. They change color as they ripen, so ripeness is easily assessed, and yellow bananas pretty much taste the same when ripe. You would think the consumer feedback would all be positive given how easy bananas are to get right… but that was not the case. Here are actual shopper statements.

-

“I’ve tried getting these bananas five times and they always show up split.”

-

“Somehow I managed to get bruised and abused sad bananas. The package was incorrectly put together and these were at the bottom of my other items inside the tote bag. They had no chance of surviving.”

-

“This is what arrived this time, smashed and bruised.”

Q: These comments are brutal for both the retailer and the supplier…

A: These comments highlight a big challenge — packaging produce for safe delivery. There is an opportunity here. If you are working with an online retailer who is picking orders from a store, say via Instacart, it can be harder to control the experience an online shopper will get because it comes down to the pickers and how they are packing your products into the tote.

Q: Fresh Direct prides itself on hiring expert produce people that know how to pick and pack, etc.

A: In looking on the Fresh Direct website, I don’t see anything promoting who picks/packs. I think it is a really important message. In Seattle, there were ads for SHIPT, and the website was promoting the people behind your order selection.

However, if you are working with a DC or fulfillment center, where product is not on display, then there are opportunities to get creative with your packaging. In the online world, your product has to survive mechanized distribution, and packaging can play a role in ensuring the consumer gets a good experience with your product.

Consider this: In online sales, your packaging is important not only in the terms of protection and the ’last mile’, but also in terms of the ‘unboxing.’ Google the words ‘unboxing’ and there is a whole community that follows people who buy products online and then ‘unbox’ them. Crazy I know, but it’s something we don’t even consider in fresh produce or online selling.

Why can’t a package that is used to pack and ship grapes be exciting and educate shoppers about other varieties from the same sales company? Why can’t a bag or punnet of apples talk about other varieties as part of the ‘unboxing’ process? This may seem far-fetched now, but I think this is a ‘watch this space.’ And this is only the tip of the iceberg. Online packaging gets sent to captive shoppers — shoppers who are interested and excited to receive your products. Surely more can be done with this opportunity — but it does require awareness and transparency between retailer and supplier.

Q: This goes back to partnerships and the need to share data between retailers and suppliers, yet the produce industry has traditionally been averse to that…

A: I think online shopping takes away control from suppliers and impacts the ability to educate shoppers in a meaningful way. What we have found in China, where we use packaging as a promo tool, is our retail partners have been open to ideas we brought to the table… but we had to bring the ideas to the table! What a produce company can control is the ideas they bring to the table which is why companies have to be overly proactive during this time.

Q: How will omni-channel trends impact private label? The consumers have been used to going into the store and buying what has been available to them, but in a new world, they have many options…

A: There are so many ways to answer this question. The UK has been selling private label brands online since the 1990’s, and most produce is sold private label. While I never like to say never, I struggle to see an evolution to grower branding unless the brand is big, spends big or has a significant point of difference. Brands like Driscoll’s, Dole and Chiquita are sold branded, but they are global powerhouses.

In other countries, I see the private label produce segment only getting bigger… and it is a real threat. If you are a big produce brand with strong brand investment and a market presence, you may be safe from a more genericized, private brand offer. But if you are a medium producer, with no brand or differential advantage, you risk being swallowed up into a house brand product.

Q: This is an important point…

A: It all comes down to trust.

Go back to the blueberry example. On FreshDirect.com, there were three blueberry packs on offer: Driscolls, 6oz, Jumbo berries; a no-brand 11oz punnet of organic blueberries and a no-brand, 11oz punnet of normal blueberries. While the no-brand punnet was not labelled FreshDirect blueberries, it could easily have been – allowing FreshDirect.com the opportunity to showcase its online brand values of freshness, quality, etc.

If you, as a regular online FreshDirect.com shopper, know FreshDirect and trust FreshDirect because of past good experiences with its fruit and veg, it only makes sense for FreshDirect to have its own brand because consumers trust the name. In the future, I can see more and more online retailers offering a ‘house-brand’ as a way to drive their sales and profits based on the trust factor.

One final thought: Amazon Prime has over 100 million members who trust and love the Amazon brand and what it stands for. Amazon already has 60 private label brands and thousands of products within its Amazon Basics range. Why wouldn’t Amazon leverage this for fresh produce at some point?

Q: Moving to voice recognition, with Amazon Echo. If consumers tell Echo, ‘I need more bananas,’ what are they going to get? Could this lead to people expressing exact preferences — I want Chiquita bananas – and perhaps retailer will feel obliged to buy them or say, “Sorry we don’t have Chiquita, but we have an excellent private brand…”

A: Never a dull moment, is there! Just when companies start to believe they are getting a handle on their online presence, bam, along comes voice ordering and disrupts any semblance of getting things under control!

I believe voice has a whole new dimension, one even the big CPG companies are only just getting their heads around. In all my research, I have not yet seen any produce company taking ownership in this space.

CPG companies are paying to enhance the way Alexa voice operates with their products.

Q: In what ways?

A: For example, you can ask Alexa, give me a Stubbs barbeque, and Stubbs has paid to have the consumer get a certain experience.

In the videos I watched for Stubbs barbeque sauce, the voice that speaks to you is the Stubbs founder’s voice, and you can ask him a range of questions, and the answers exhibit his personality: Alexa, I feel like chicken for dinner… he answers, we can do chicken with barbeque sauce and then have a beer. In the same way, “Alexa, I feel like a Patron Tequila,” and Patron has paid to have a certain message for Alexa to answer the request in a defined way.

What I can share so far is, from our work in brand naming, the arrival of voice is already changing how we look at brand name creation for clients. The way we will go about creating brands and new product names for the future will be driven by voice-controlled shopping. For the generation after Gen Z, the generation that is growing up with smart phones or tablets in their hands since birth, voice control is their future.

To better understand this, find and watch the “Generation Voice” ad just released September 2018 by Spark New Zealand. In one minute, this shows you how voice control will disrupt everything.

Q: It certainly does. The book, The Long Tail, looked at the reason why Amazon was going to destroy all book stores because even the biggest book stores could only stock 20,000 books, but Amazon could offer many millions, including those out of print.

How will omni-channel develop for produce? Will there be greater availability of options? Will issues specific to produce affect decisions?

A: To gaze into the future, we need to look beyond the USA. While the Amazon/Whole Foods deal and the fast-paced disruption it caused in the USA is notable, it is not necessarily the best case study. To see the future, I look to the UK and China.

In the UK, Ocado is the future, now. I read an interview with Tim Steiner, Founder and CEO of Ocado, who provided a snapshot of the UK online environment and Ocado’s place in it.

-

7-8% of the UK grocery market is online vs 1-2% in the USA.

-

For Ocado, 44% of the company’s sales come from its refrigerated facilities. When ambient products like potatoes and bananas are added into the total, over 50% of Ocado’s sales are fresh foods.

The interview talked further about Ocado’s keys for success: low price, product variety and one-hour delivery from 5:30am — 11:30pm seven days a week. How do they achieve this? With smart supply chain technology. Ocado uses automated distribution centers that can pick up to 1.5 million items per day each. The company’s proprietary technology is supported by 1,300 engineers. The result of all this tech: 99% order delivery accuracy and an average order fulfillment time of 15 seconds. Compare this to standard order fulfillment time using in-store pickers of 74 minutes. This is the future for fresh.

China is similarly impressive. They leapt over the West’s brick-and-mortar dominance and went straight to online when China opened up to imports and brands and the Internet and smart phone arrived en masse. These changes led to massive innovation in selling B2B and B2C goods (Alibaba, TMall, JD.com), the online selling of premium, imported fruits (Fruitday.com, MissFresh.com) and fully integrated social apps and payment systems (Alipay, WeChat pay). I spend time in China, and I can assure you it is way ahead of the pack when it comes to online selling, social chatting and payment integration!

And now, China is changing again. China’s vision for ‘new retail’ or O2O (online to offline) means the big online players like Alibaba and Tencent’s JD.com are making significant investment in brick-and-mortar stores. Offline players like specialist fruit shop, Pagoda, with over 2,000 small stores, are moving online.

If I had to summarize, what all countries and all companies are realizing about Fresh is it is unique versus CPG and other fresh categories. I feel somewhat vindicated when I repeat what I have been writing about and speaking about for 25+ years – fresh is different. It is sensorial. In the offline world, it is hard to replace the impact of seeing, touching, smelling and tasting fresh produce with a non-sensorial online experience. As the UK shows, it can be done, but it requires huge investment in automated systems to do this well. And this level of automation remains untapped in most of the world.

To summarize: omni-channel is here to stay. We need to stop referring to this as new or disruptive and start thinking strategically about how your brand or company will thrive in the new norm. If you are not embracing this change, if you are waiting for online selling to ‘come right’ so it works for you, if you are not actively starting to think about how this will impact your business, your sales or your brand…you are already behind.

***********

Many thanks to Lisa for working so hard, thinking so deeply and traveling so far to help the industry enter the brave new world of omni-channel retailing in a way that will produce profits and success for all.

It is so easy to ignore the future… and it would be such a mistake to do so.

Without a doubt, the people and companies that will succeed tomorrow are those that prepare today.

And the best way to prepare for the future? Is to help create it.

The Amsterdam Produce Summit gathers the best and the brightest for education and interchange to understand and to help create a new tomorrow for the produce industry.

Come join us in Amsterdam and position yourself and your organization to be a winner in the years ahead.

You can register for The Amsterdam Produce Summit right here.

If you need a hotel room in our headquarters hotel, just let us know here.

If you want more information about the Spouse/Companion Program, just ask here.

And let us know here if you want information on the tours, conducted on November 14, one day after our one-day conference.

If you are interested in exhibiting or sponsoring the event let us know here.

This is the only event of its type in the world. Come be a part of it. Come to The Amsterdam Produce Summit.